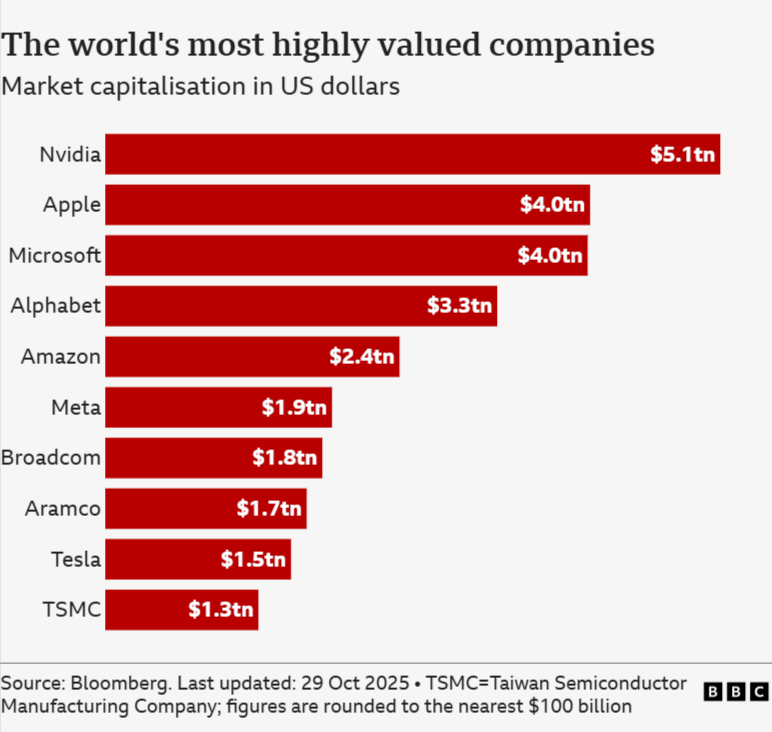

In a groundbreaking moment for technology and AI, Nvidia has officially become the world’s first $5 trillion company, marking a turning point in both the semiconductor industry and global financial markets. This milestone, reached on October 29, 2025, cements Nvidia’s dominance in the artificial intelligence era and showcases how AI has reshaped modern economics.

The Fastest Growth in Corporate History

The speed of Nvidia’s rise is nothing short of astonishing. It took the company just three months to go from a $4 trillion to a $5 trillion valuation, with its stock surging over 50% in 2025 alone. For context, Nvidia was valued at only around $400 billion before the AI boom began in late 2022.

In the last five years, the company’s market cap has soared nearly 1,500%, driven by massive demand for its GPUs, the foundational hardware behind the world’s most advanced AI models, from ChatGPT to Gemini. This remarkable trajectory makes Nvidia not only a market leader but a symbol of the AI revolution itself.

Why Nvidia Leads the AI Race

At the core of Nvidia’s success lies its unparalleled dominance in the AI chip market. The company controls about 90% of the GPUs that power massive data centers for tech giants like Microsoft, Meta, Amazon, and OpenAI. These chips are the backbone of AI innovation, training and running large language models that define the next generation of digital intelligence.

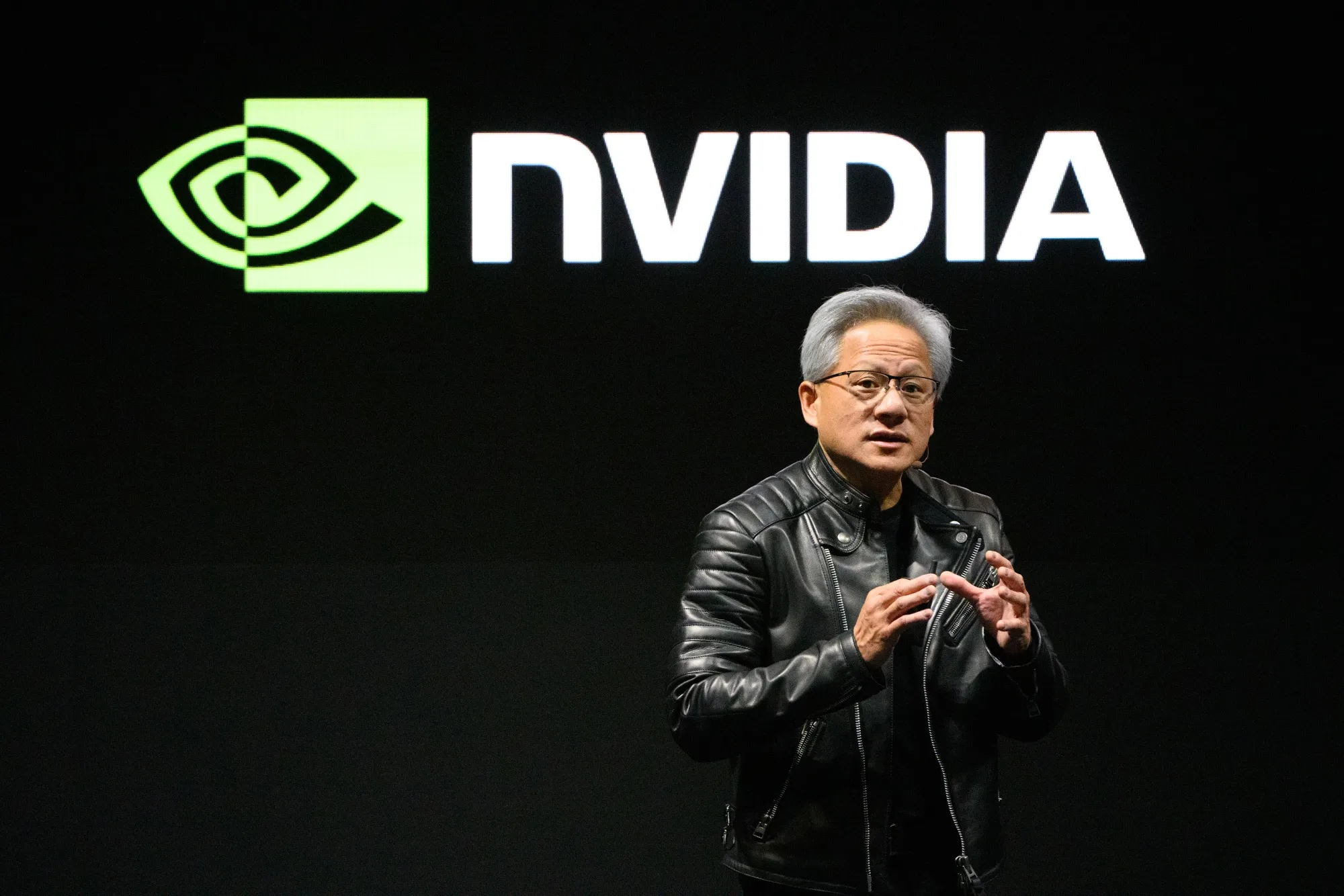

CEO Jensen Huang announced during Nvidia’s GTC conference that the company has secured over $500 billion in AI chip orders through 2026, providing unprecedented revenue visibility. Huang claimed that they are likely the first technology company in history to have visibility into half a trillion dollars in revenue. This demonstrates how significant AI’s economic potential is.

A Global Economic Shift

With a market capitalization of $5.05 trillion, Nvidia now stands $1 trillion ahead of Microsoft and Apple, illustrating the extraordinary concentration of value among AI-driven firms. To put this in perspective, Nvidia’s valuation surpasses the entire cryptocurrency market and represents nearly half the size of Europe’s Stoxx 600 equities index.

Economists highlight that AI-driven data center investments, the majority of which are powered by Nvidia chips, accounted for more than 90% of growth in U.S. GDP in the first half of 2025. This demonstrates how thoroughly AI has become integrated into the global economy.

The Bigger Picture

As AI leaders and analysts debate whether this surge signals sustainable innovation or an early-stage bubble, one thing is clear: Nvidia’s meteoric rise reflects the transformative power of artificial intelligence.

Nvidia becoming the world’s first $5 trillion company isn’t just a financial milestone; it’s a defining moment in how technology reshapes industries, wealth, and the future of human progress.

Follow AI Times for the latest AI news, insights and detailed coverage of AI innovations.